It’s The (tax loss) Harvest Season!

This week’s blog post is being written on the first of November. October has gone by, and here in Maine, the leaves have been falling almost as quickly as stock prices.

While declining stock prices are not a popular thing in and of themselves, the fact is that it is inevitable from time to time that they’re going to decline. This dynamic does make for opportunities to add value by selectively taking advantage of the ability to offset gains in a portfolio with losses, reducing tax liability as the portfolio grows, thus leaving more assets in the portfolio to grow.

How big of an effect can this have? A study published in May 2016 found that maximizing a stock portfolio for ‘tax optimization’ can add about 100 basis points (that’s about 1 percent) in annual value![1]

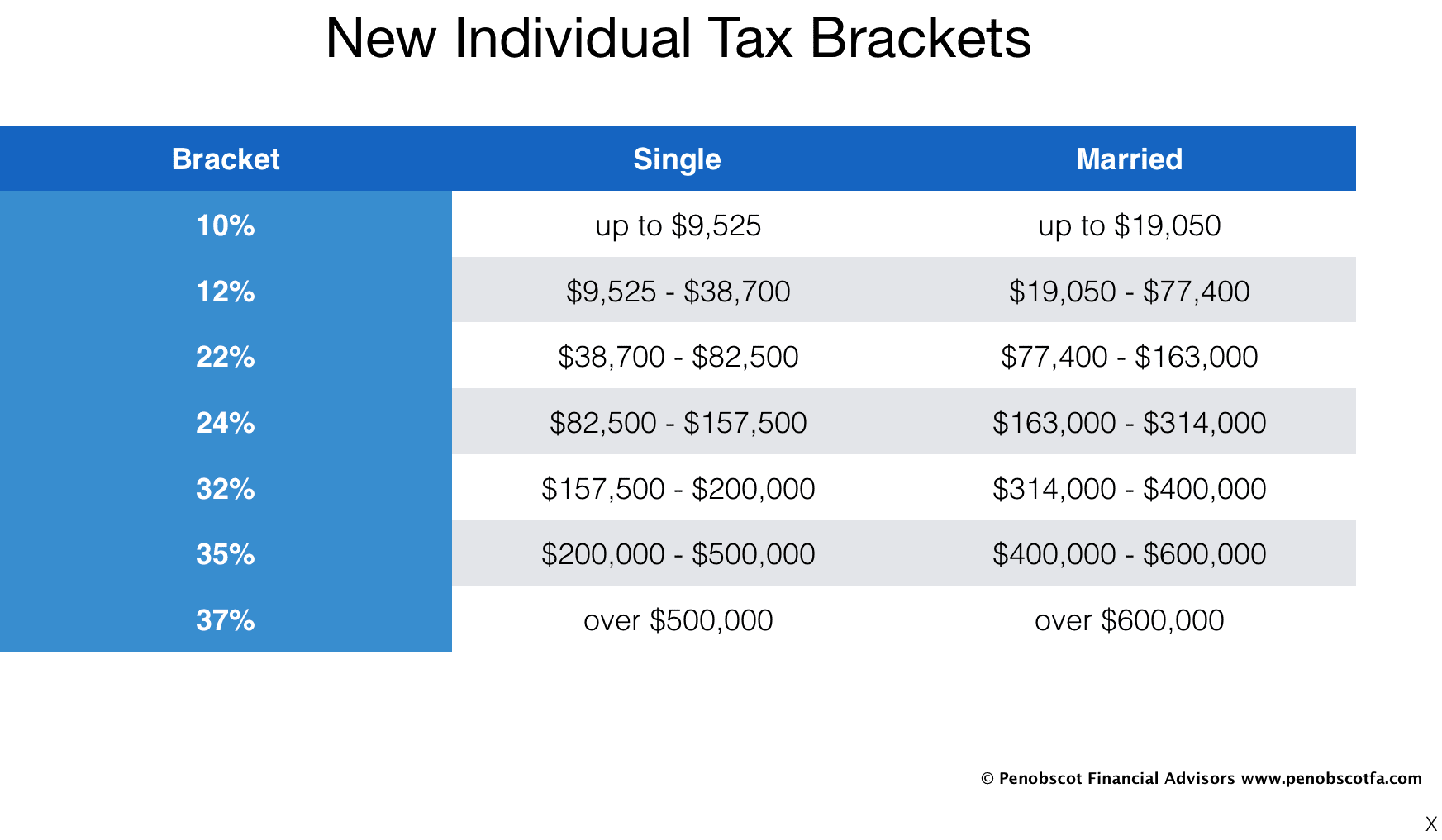

Income is taxed a few different ways. “Ordinary Income” is subject to a progressive series of tax brackets, running from 10% to 37%.

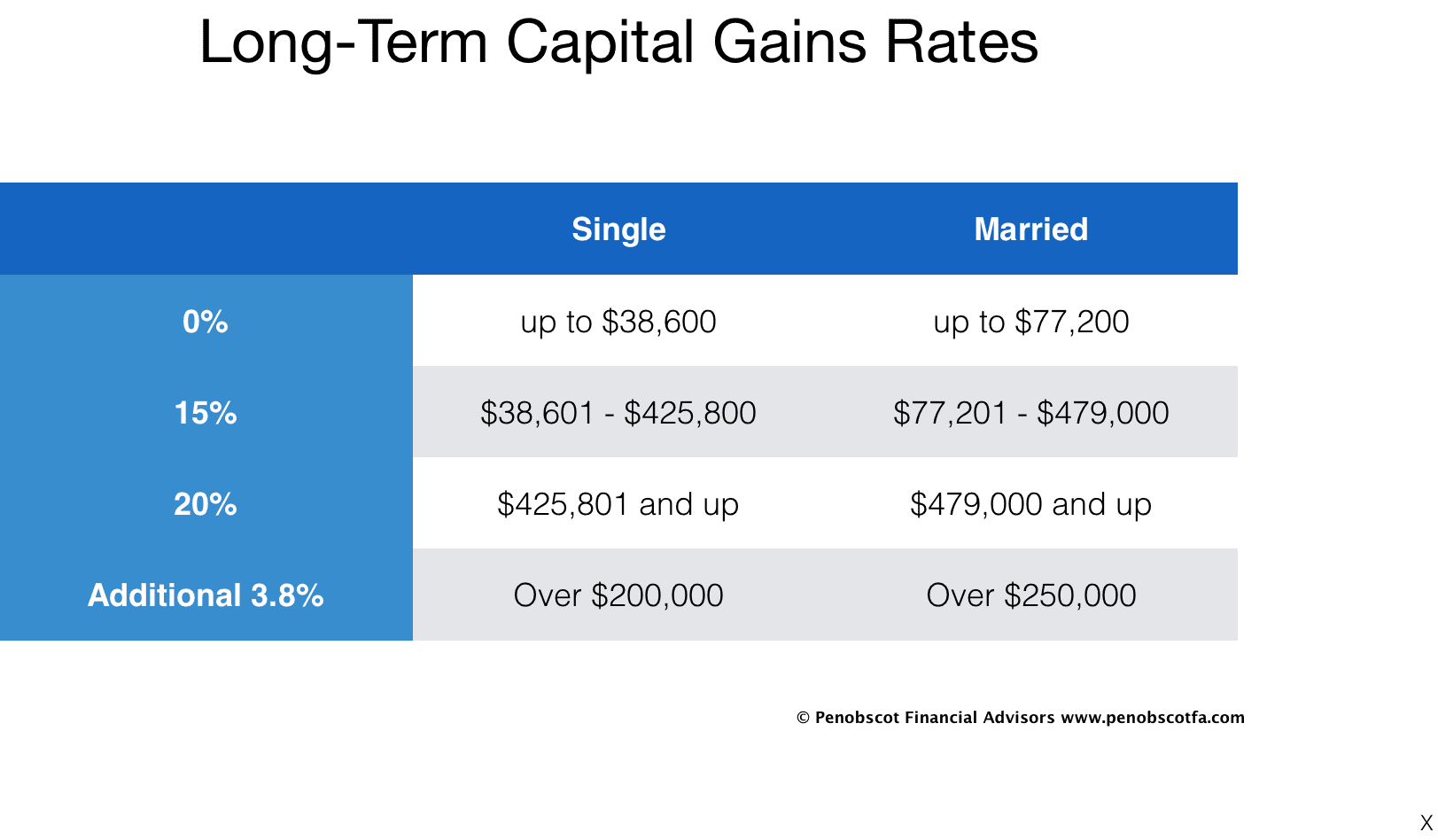

On the other hand, Long-term capital gains (or income on an investment held at least one year) are taxed at lower rates:

On the other hand, Long-term capital gains (or income on an investment held at least one year) are taxed at lower rates:

Short-term capital gains (gains on investments held for less than twelve months) are taxed at ordinary income tax rates.

Short-term capital gains (gains on investments held for less than twelve months) are taxed at ordinary income tax rates.

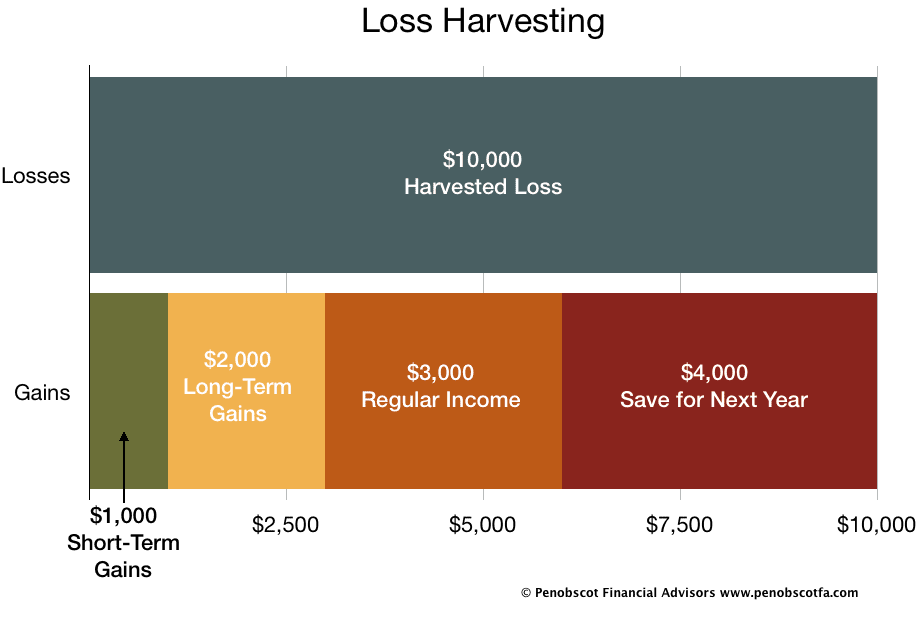

The idea behind tax-loss harvesting is relatively simple: By selling assets that are worth less than what has been invested, some of these taxable income sources can be neutralized. In the example below, our investor sells an investment that is valued at $10,000 less than her total investment in the position (commonly called ‘cost basis’.)

Now, let’s say, aside from the loss investment, that our investor has income in this tax year in the following amounts:

| Short-Term Capital Gains | $1,000 |

| Long-Term Capital Gains | $2,000 |

| Regular Income | $35,000 |

The $10,000 in realized losses can be used to offset all of the short-and long-term capital gains, for a total of $3,000. Additionally, another $3,000 of realized capital losses can offset regular income. That makes a total of $6,000 that can be deducted in the tax year for our investor. The remaining $4,000, though, is not lost. That amount can be ‘carried forward’ to the following tax year, to again offset capital gains and up to $3,000 of ordinary income.

For the purposes of our example, if our investor happened to be in the 24% tax bracket, the losses are used to eliminate .24 x $4,000 = $960 of ordinary income tax at the marginal bracket plus $3,000 x .15 = $450 of long-term capital gains tax at the preferred bracket, for a total of $1,410 in tax savings! Plus, another $4,000 goes toward saving against taxes due next year.

For the purposes of our example, if our investor happened to be in the 24% tax bracket, the losses are used to eliminate .24 x $4,000 = $960 of ordinary income tax at the marginal bracket plus $3,000 x .15 = $450 of long-term capital gains tax at the preferred bracket, for a total of $1,410 in tax savings! Plus, another $4,000 goes toward saving against taxes due next year.

A couple of rules to be followed; first, any loss must actually be “realized.” In other words, just a decline in value is not enough to claim a capital loss. The investment must actually be sold in order to realize the loss. Additionally, an investor cannot purchase the sold investment again within the 30 days following the sale (something called the ‘wash sale rule’.) If a sale is determined to be a wash sale, the realization of the gain will be disallowed, and treated as if the investor hadn’t sold at all.

Strategies like tax-loss harvesting and asset location can make a substantial difference in the overall, after-tax, return of an investment portfolio, and as such are worth paying close attention to. After all, it’s not what you make in an investment portfolio that matters… It’s what you KEEP!

Tax-loss harvesting, by the way, is one strategy that lends to the tax-efficiency of a portfolio. Having said that, some people can actually take advantage of ‘harvesting’ capital GAINS for optimal after-tax results! Sound unbelievable? Check in next week for more details.

[1] Source: WEnvestnet PMC’s Capital Sigma: The Return on Advice