Purchasing a piece of paradise

Hey, I love living in Maine and I love winter as much as the next guy. But somewhere around the middle of February, I start to scan for cheap flights to… well, anywhere I can go outside with a t-shirt. (Okay, if I were a ‘true Mainah’, I’d be in short sleeves when the temp goes above 20!).

Not too long after my arrival in a vacation spot, I inevitably start to scan the local real estate listings to see how affordable (or, most often, UN-affordable) it would be to purchase a vacation home in the area. There’s always some degree of fantasy built in with this practice. Let’s face it: We tend to romanticize an area if, any time we’re there, it’s to get away from the stresses and doldrums of every day life. Obviously, there is a large industry that COUNTS on us becoming romantically attached. Timeshares, vacation clubs, and local real estate outfits strive to take advantage of this affliction – and, in some cases, their sales practices attest to the need to get us to act quickly on our infatuation before it wears off!

Like with most planning issues, there is NOT a simple, universal answer to the question of whether it is prudent to purchase a vacation residence, or a portion of one. For some folks, purchasing a vacation home can be the perfect combination of financial and non-financial outcomes; it can be a place where great memories are created, that span generations! Owning a vacation property also has the potential to be a wise investment.

For many, however, the fantasy of owning a place should stay, like in my case, just a fantasy.

Arguments for and against taking the leap can broken up into “financial” and “non-financial” categories.

THE NON-FINANCIAL STUFF

A good practice is to start by measuring some of the non-financial factors. Using the scale above, assess the following statements:

I’m interested in always vacationing in the same spot

Either I’m retired, soon to be retired, or I get a bunch of vacation time

My Kids/Spouse/Partner is/are completely jazzed about this place

I don’t need rental income to swing this

I can easily get there to do maintenance

I know of someone who can reliably manage the property

I can pay cash for the place

I know people who have vacation homes in the same locale

I don’t already have a lot of my net worth in real estate

If your responses are largely on the “OH YEAH” side of the meter, it may very well make sense to go to the next step and start calculating the financial impact of buying a vacation home. If, on the other hand, a majority of the responses are tending toward the left side of the meter, it’s probably not worth the time of crunching numbers. In that case, should you decide to return to the vacation spot, go with the hotels or AirBnB/VRBO approach.

THE FINANCIAL STUFF

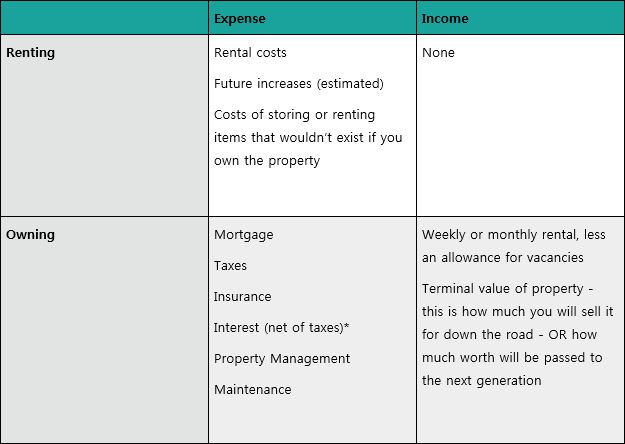

If the non-financial criteria line up and there are opportunities for ownership, the next step is to measure the financial impact of purchasing a property versus simply continuing to rent. The idea is a simple one: figure out the present value of the cost of owning property and subtract the present value of the cost of renting hotel rooms or a house. If the resulting number is positive, it makes financial sense to buy.

BUT, while the idea is simple, the actual calculation can get a little complex. First of all, we need to discount future cash flows back to present value numbers. Simply put, if we have a choice of renting a place for $1,000 for 5 years or paying $5,000 up front to use it for 5 years, we should choose the former. Expenses today cost more than expenses in the future (since you can put money aside that can grow to meet the future expenses). In the same way, income in the future is worth less to you than income today. It’s way better for me to give you $1,000 today than $1,000 ten years from now.

As geeky financial advisors, we have ways of determining reasonable discount rates and of doing all of the calculations behind this – but the trick is knowing which elements of expense and income we need to take into consideration.

- The Tax Cuts and Jobs Act of 2017 may slightly change the calculus on interest costs. While you can still deduct interest for a vacation home, the amount of debt between your two homes that has deductible interest has been reduced from $1 Million to $750,000. Also, with the expanded standard deduction and the limits on deductibility of state and local taxes, mortgage interest has to clear higher hurdles to be deductible for most.

I think the one piece of advice that should apply universally is this: Don’t accept the dog-and-pony show offered by many resorts while you are visiting. You’re simply not in the right frame of mind when you’re on vacation to do the honest soul searching (and onerous financial calculations) to make a prudent decision. Forego the free toaster or whatever the lure is – come home, sit down, have a talk, chat up your advisor, and make a pragmatic decision.

The outcome will be that, if you do decide to buy, you can be comfortable that this will be a good decision you’ll be happy with for a long time. Too often, an otherwise nice getaway spot is ruined because of financial woes that come with a hastily acquired vacation property.

Meanwhile, I’ll be happy to join you in going through the real estate fantasy process!!