Is the dollar strengthening or weakening – and why should you care?

I’m really looking forward to attending the 2019 CFA Institute Annual Conference, in May. Beyond offering an unmatched lineup of speakers and workshops, the conference is usually held

in a fascinating city. This year, the conference is in London, one of my favorites (if only because I can read the menus with a fair amount of ease.)

One thing weighs upon me as I’m making the arrangements. Somewhere between now and the conference are deadlines for the Brexit negotiations. One somewhat far-fetched possibility is that a second referendum is forced, leading to the possibility of a ‘remain’ vote. But the more likely outcome is (seemingly at even odds) either a ‘no-deal’ Brexit, or some kind of organized deal. The outcome could impact on my cost of attending the conference.

More on that later, but the gist of today’s conversation is the dollar – or, more the point, currency movements in general and why we should pay attention to them.

One thing I find myself needing to correct my flight students on frequently is when they refer to wind and its impact on a plane in flight. At the risk of getting too geeky, let me just say that, once you’re off the ground, there is no such thing as wind. Wind is only felt by virtue of the fact that, when you’re standing on the ground, the ground is moving at a different speed than the air.

In the same way, currency movements only occur relative to other currencies. So if we talk about the dollar ‘strengthening ‘ or ‘weakening’, we can only really observe these phenomena relativeto other currencies. Trouble is, the dollar may be strengthening relative to one currency while at the same time weakening relative to another. To simplify things, though, when we refer to a strengthening or weakening dollar, we’re usually talking about the dollar’s movement versus a ‘basket’ of other currencies.

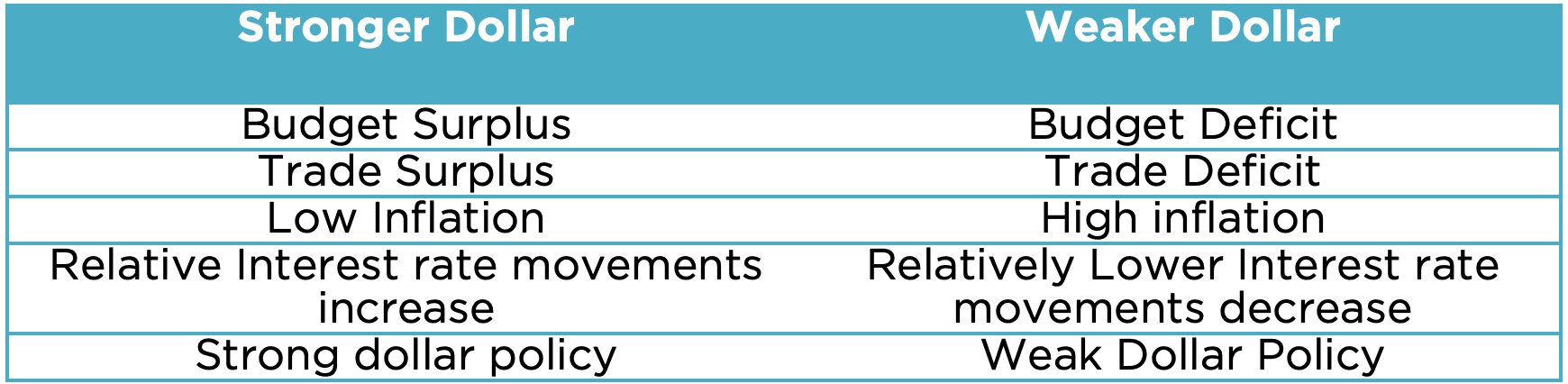

Currency movements are notoriously hard to predict, especially in the short run. However, five factors seem to drive the relationship between currency pairings, especially over longer periods of time. These factors are:

- Trade deficits/surpluses– in situations where the US runs a trade deficit, the impact is that we purchase more goods or services than we export. Since we use dollars to buy goods, we’re essentially flooding the global market with dollars. Whether this is a good or evil thing may be open to discussion, but any time you flood a market with anything, the price of that thing tends to go down. If supermarkets in Bangor Maine had too high a supply of bananas, there would suddenly be a sale on bananas. Thus the current trade deficit may have a weakening effect on the price of the dollar, relative to other currencies.

- Budget deficits/surpluses– When we spend more than we make, that creates a budget deficit. Countries (and households) that run significant deficits over periods of time are generally considered less credit-worthy than those that run surpluses. Since our bonds (our debt) trade in local currency, if our debt becomes less attractive, so will our currency. Large projected deficit arising from stimulus spending and recent tax cuts might send the dollar lower relative to currencies of countries who aren’t facing large deficits.

- Inflation– Inflation weighs on a currency by making goods and services priced in that currency more expensive and thus less attractive to international buyers. So far we haven’t seen substantial inflation in the US for a good number of years, so this may not be of immediate impact – but markets are watching closely for clues that the current tight labor market may result in inflation picking up.

- Interest rates– If investors get a higher return on dollar-denominated bonds, there will be more demand for them, and our currency will go higher. Some economists think that US interest rates are slowing their gains while interest rates in Europe have yet to pick up. Should overseas interest rates start to move upward versus US rates that are slowing, that could weaken the dollar.

- Policies of Political Leadership– Political regimes have some capacity for moving currency. The current administration in the US touts their support of the manufacturing sector. This sector benefits from a lower dollar by making their products more affordable on the international market.

Looking at all these factors, if you conclude that the US dollar may weaken versus foreign currencies over the coming years, it should impact your behavior in a couple of ways. First, from an investment standpoint, a weakening dollar improves the outlook for investments that are based in currencies that may strengthen versus the dollar. If the dollar depreciates 5% versus the Thai baht (their currency), and we held a Thai company in our investment portfolio, and the value of that company went up by 8 percent, we’d actually make 13% on our investment. Similarly, if the dollar had strengthenedby 5% versus the baht, we only would have made 3%. Investors who forecast a weakening dollar do well to increase their allocation to non-US investments.

Our outlook for currencies will also impact our activity as consumers on the international market. Going back to my dilemma, I can purchase my hotel room for the conference today for £220 per night. At the current conversion rate of $1.30 per pound that translates to $286 per night. Some economists are projecting that the pound may appreciate significantly in case of a deal being reached in Brexit. On the other hand, there may be a significant decrease in the pound-dollar relationship if there is a ‘no-deal’ Brexit. Some say it might be as big a difference between $1.45 dollars to the pound if there is a deal, and only $1.05 dollars to the pound if there’s no deal. What that means is that, if I wait, the price of the hotel room might go up to $319 if there’s a deal, or down to $231 if there isn’t.

In the end, I’ll probably hedge somewhat by locking down the hotel now, since I can’t really pre-pay my meals – hedging my bet, somewhat.

And I ponder – if I may be in London in May, may Theresa May still be there in May?

The information in this blog is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.