Have you heard of 529 ABLE accounts? They just got better.

The importance of financial planning is especially significant for people living with a disability.

Living with a disability can be expensive, whether as the result of the need for treatment, physical or occupational therapy or adaptive equipment. Unemployment is twice the level for people with disabilities as those without.

When families and friends try to provide support for loved ones with disabilities, however, they can find it challenging, especially when the individual is younger.

Social Security provides two resources for support in these cases: Social Security Disability (SSDI) and Supplemental Security Income (SSI). The main difference between the two is the fact that SSDI is available to workers who have accumulated a sufficient number of work credits, while SSI disability benefits are available to low-income individuals who have either never worked or who haven’t earned enough work credits to qualify for SSDI.

In the case of younger people with disabilities, SSDI is usually out of the question because they haven’t tallied the requisite number of work credits. SSI, however, becomes unavailable if the recipient has over $2,000 in assets ($3,000 if married) – or if the beneficiary has 2019 income of over $771 per month. Gifting someone with disabilities additional resources for such things as education, job training and support, healthcare and financial management becomes counter-productive, since it makes them ineligible for SSI. Since SSI is also an entryway to Medicaid eligibility, these benefits were also subject to forfeiture.

In December 2014, the ABLE act (Achieving a Better Life Experience Act) was signed into law in order to partially address these issues, by creating a provision for a special type of savings vehicle, called the 529 ABLE account.

529A (ABLE) accounts look a lot like Educational 529 plan accounts in a number of ways. First, contributions are not deductible federally (although there are often state tax benefits), and contributions are always distributed tax-free. Additionally, just like their education counterparts, assets in 529 ABLE accounts grow tax-deferred, and qualifying distributions of growth are tax-free. Also, just like with traditional 529 plans, the growth distributed for non-qualifying purposes is taxable and subject to a 10% additional tax.

Qualifying distributions for 529 ABLE plans are a bit different than Qualifying Higher Education Expenses with educational 529 plans. A “qualified disability expense” means any expense related to the designated beneficiary as a result of living a life with disabilities. These may include education, housing, transportation, employment training and support, assistive technology, personal support services, health care expenses, financial management and administrative services and other expenses that help improve health, independence, and/or quality of life.[1]

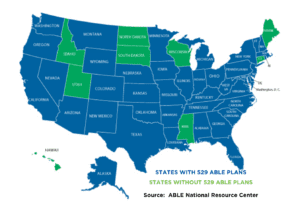

When the ABLE act was passed in 2014, it required that residents use their own state’s 529 ABLE plan. Fortunately, for folks in states like Maine, where no such plan has been established, the residency provision was eliminated by congress in 2015. As such, many states have no residency requirement, and a number of companies have established “nationwide” 529 plans, that can be used by residents of any state. This, too, is closely related to education 529 plans.

When the ABLE act was passed in 2014, it required that residents use their own state’s 529 ABLE plan. Fortunately, for folks in states like Maine, where no such plan has been established, the residency provision was eliminated by congress in 2015. As such, many states have no residency requirement, and a number of companies have established “nationwide” 529 plans, that can be used by residents of any state. This, too, is closely related to education 529 plans.

Contributions to 529 ABLE plans are limited to $15,000 per year (the current gift tax exemption.) However, if the beneficiary of the plan is employed, he or she can also put up to the 2019 federal poverty line for a one-person household into the account (another $12,490 in most states). Some states allow for up to $300,000 to be contributed to the 529 ABLE plan.

529 ABLE plans are available to people who had a disability diagnosis prior to age 26. That doesn’t mean that a person can’t have a 529 ABLE plan beyond age 26 – just that the diagnosis had to occur before then. Eligibility for SSDI and SSI automatically fulfill the definition of ‘disability’ for 529 ABLE plans – but someone not receiving these can get documentation from their doctor to qualify for participation.

SO here’s the really great thing: A 529 ABLE account owner will NOT forfeit SSI benefits (and Medicaid) until their 529 ABLE account exceeds $100,000. That’s a huge benefit (beyond the obvious tax benefits) and it creates a hugely valuable opportunity for people with disabilities to create much more significant financial security – and, well, A Better Life Experience!

The Tax Cuts and Jobs Act of 2017 (which went into effect January 1, 2018) made these accounts even more attractive. First, they made 529 ABLE account contributions made by the beneficiary eligible for the “savers credit.” This amounts to a governmental subsidy on top of the contributions made by the person with disabilities and their loved ones.

Secondly, the new tax act made it possible to move up to $15,000 per year from an educational 529 plan to a 529 ABLE plan, tax-free. This is a great planning tool. Take a situation where an uncle wants to contribute to his nephew’s education, but since the nephew has an autism diagnosis, he’s not sure if the nephew will actually have the Qualifying Higher Education expenses that will yield the tax benefits he’s looking for. Knowing that the flexibility will exist to divert these to a 529 ABLE plan makes it much easier to make the contributions to the educational 529 plan and to monitor the situation as the nephew ages. In the case of the nephew NOT using the assets for higher education, they can still be available without jeopardizing SSI.

529 ABLE plans aren’t nearly as well-known as their education counterparts. But, given all of these benefits, it’s time to spread the word about them!

[1] Source (and a great resource for further information about 529 ABLE plans): ABLE National Resource Center’s website at ablenrc.org