I changed jobs! What do I do with my old 401k?

First off, congratulations! You’ve endured a process that many of us loathe, including updating resumes, a handful of interviews and a lot of anxious waiting. Now that you’ve landed yourself in a new position, at a new company, you have a lot of learning to do- learning what the job entails, learning new procedures and technologies, and one of the things you’ll be learning about right off the bat is the new benefits package that your company offers, including their retirement package.

Once you’ve settled on the benefits package that’s right for you, you’ll likely start figuring out when you can start contributing to a retirement plan. Depending on your employer, you may be able to enroll in the plan immediately, or they may have a waiting period. As soon as you are eligible, you’ll want to make some decisions regarding contributions, and what to do with your ‘old’ retirement plan at your previous employer.

What is a rollover?

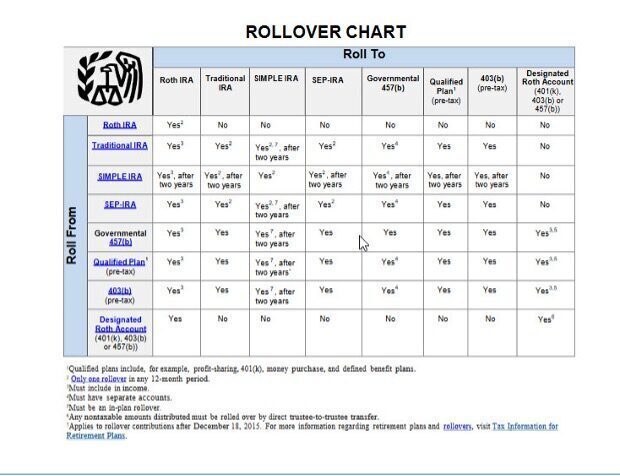

Simply put, a rollover occurs when you move funds from one retirement plan into another retirement plan. The movement could be from an employer sponsored plan, like a 401k into an IRA, or from an employer sponsored plan into another employer sponsored plan (401k to 401k). While distributions from retirement plans can be subject to taxes or early withdrawal penalties, rollovers are not. The chart below shows the rollovers that you can perform depending on the type of account that you have.

A financial advisor can help you evaluate whether a rollover is the best option for you. Items to consider include: expenses, investment options, plan rules and plan features. The IRS has rules about when rollovers can occur. SIMPLE IRA’s even have rules about when rollovers can occur. There can be serious financial penalties and tax consequences if a rollover is not processed correctly.

How do I process a rollover?

There are a handful of steps to make sure a rollover is processed correctly. If you and your advisor have decided a rollover into your new retirement plan is the next move, you’ll want to follow the below steps to roll your account over:

- Contact the current custodian to determine rollover requirements and request paperwork.

Each custodian has different requirements when it comes to rollovers. Some have their own forms they want you to submit, others will accept a form from the receiving firm. It’s never a good idea to google the requirements of the current custodian because a form you obtain online may be out of date, or only applicable to a certain type of rollover. We always recommend calling the current custodian and asking what form is required, and how to obtain it. In most cases they will be able to mail you the form, or if you still have access to an online portal, they may be able to post a form to your login page. If you have a current statement, you should be able to a find a phone number to contact the plan’s custodian.

2. Ask how to return the paperwork.

It’s always good to find out how to return the paperwork. Sometimes they’ll want an original signature mailed back, sometimes the form can be faxed, and other times it can be emailed or sent back through an online portal. Here at PFA, we always ask for an overnight mailing address so that we can send forms back through UPS with tracking. Often, custodians will not provide their overnight mailing address on the form so it’s always a good question to ask. If the form can be faxed, ask for their fax number. Knowing where to send the form back is key to getting it processed in a timely manner.

3. Ask if your signature needs to be notarized, or if a signature guarantee is required.

In most cases, the answer to this question will be ‘no,’ but in the off chance the answer is ‘yes,’ you’ll want to know that ahead of time. Reps will rarely tell you this over the phone, but will surely deny your paperwork if it’s required

4. Is a Letter of Acceptance (LOA) required?

A letter of acceptance is sometimes required by the sending firm to confirm that the receiving firm will accept the assets. You’re probably asking, “why wouldn’t they accept the funds?” Some employer plans have rules about incoming rollovers, so the sending firm wants to make sure that when they transfer the funds, the receiving firm will accept it. If a LOA is required, you’ll need to go back to the receiving firm and ask how to obtain an LOA. Often times, you’ll need to submit the rollover paperwork with a copy of your current plan statement to the receiving firm and they will be able to generate the required LOA.

5. Is employer authorization required?

In order to move funds out of an employer plan, the plan administrator may need to sign your paperwork. In most cases, you probably won’t know who the plan administrator is- and that’s OK! The plan custodian will often know who this person is and even have their contact information. If they don’t, you’ll need to contact the retirement area of your old employer and find out who the plan administrator is. If you work with a financial advisor, they can likely reach out and inquire about this on your behalf, and send the paperwork for approval if it’s needed. This can sometimes add a few days to weeks to your rollover being processed, depending on how quickly the plan administrator signs your paperwork. You may need to follow up with them to ensure they received your form and are sending it back. If you don’t ask, and this is a requirement, you’ll paperwork will end up getting rejected further delaying your rollover.

6. Is spousal signature required?

If you are married, you’ll want to ask if your spouse needs to sign your paperwork. Again, you’re probably wondering why your spouse has anything to do with your retirement account (besides being the beneficiary). Spousal consent is required if the participant is married but lists a non-spouse as a beneficiary. In some cases a participant may designate a spouse as 50% primary beneficiary and another individual as 50% primary beneficiary. Since a non-spouse is listed, even as a partial beneficiary, spousal consent may be required.

At this point, you can end the call with the current custodian and work to complete the form(s), obtain required signatures and submit for processing. Once you submit the paperwork, it’s always a good idea to follow up with the custodian after 7-10 business days to ensure your form was received and ‘in good order.” In good order means that the form was filled out correctly, and is ready to be processed. If the form is deemed ‘not in good order,’ you’ll need to determine what needs to be fixed and work with the current custodian to resolve the issue.

How do I know when the rollover is complete?

Custodians will either mail the check directly to your current retirement plan provider, or directly to you. If they mail the check to you, you can work with your financial advisor to get it applied as a direct rollover to your retirement plan. Keep in mind that if they process your rollover as a distribution, and make the check payable to you, you’ll have 60 days to deposit it into an IRA or retirement plan- otherwise, the distribution will be taxed as such and penalties may be applicable.

As you can see, rollovers can be a lengthy process, but there are certain steps you can take to ensure accurate and timely processing of your rollover. It’s always good to consult a financial advisor to make sure the rollover makes sense for your financial goals, and to avoid unnecessary penalties.