Is it Better to Rent or Buy your House?

The American dream involves, among other things, the opportunity of owning your own home. Indeed, the family house is, on average, the largest asset for the typical American family. So much wealth accumulation comes from homeownership, it is often taken as orthodoxy that we should never consider renting… Purchase the house and become an adult!

In fact, however, ownership is NOT always the best decision. Sometimes ownership is out of reach due to the high cash needs to purchase a home. Sometimes, even if ownership is in reach, though, it may still be not just okay to rent… It may be the best option, financially!

BUT, aren’t you just throwing your money away by renting?

In fact, is by giving up money with no equity to show for it mean you’re throwing it away? Perhaps. But what is often missed is that you also throw money away when you buy a house! Sometimes an immense amount of money involved in the ownership of a home goes to things that don’t accrue to any equity for the home buyer.

These costs include at least four major groupings.

- Commissions: The average real estate broker charges 5-6% to sell a house. Even though it’s the seller who pays the commission, the buyer is paying something that is going to the realtor – NOT into the home’s equity.

- Interest: Right now, interest rates are firmly above 7% for most residential mortgages. And when you first have the mortgage, the vast majority of your payments go to interest, not to paying down the note (and not to creating equity in your house).

- Maintenance: A good rule of thumb for annual maintenance on a home is to multiply the selling price by 1%. This is just a rough estimate of how much, annually, someone should count on for the inevitable need to replace a roof or a boiler or some appliance. Whether it’s termite mitigation, plumbing work, or an overdue paint job, these expenses are not contributing to your equity in the home.

- Opportunity Cost: In order to get most standard mortgages, you’ll need to generally come up with 20% in cash. (If you don’t, you may have to pay yet ANOTHER big expense: Personal Mortgage Insurance, or PMI). That’s a big amount of money you’re sinking into the investment of a house. That means it can’t be invested in other things, like stock or bond markets. This is a cost of ownership and while it can’t be specified looking forward, historical returns on more traditional investments have been higher than returns on a house.

The purchase of a house is generally what we like to refer to as a ‘leveraged investment’. This means you’re borrowing money to make an investment. In the short term, this could have some extreme outcomes. Say you purchase a $500,000 home, putting $100,000 down. If you sell next year, but prices are up by $100,000, you’ll have doubled your money… but if prices are down by that much, you’ll have lost the whole amount.

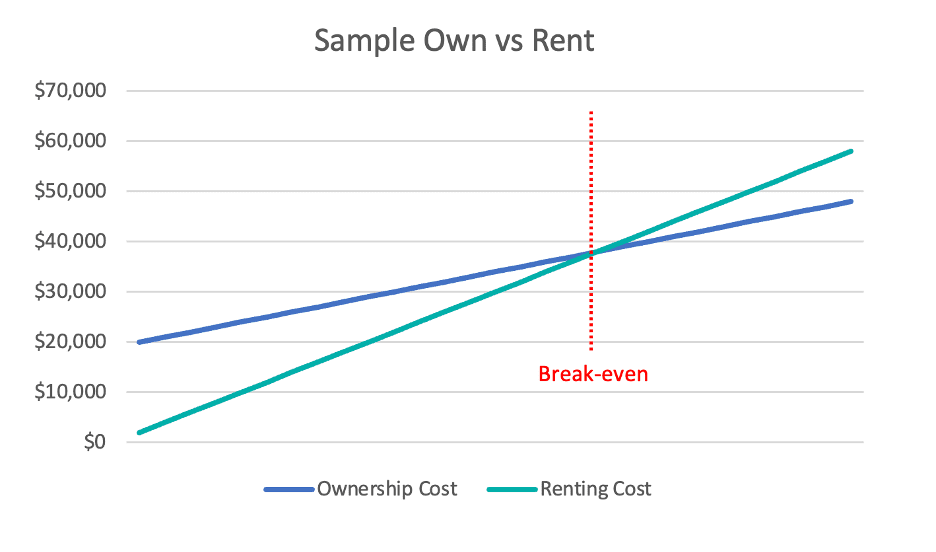

All of this leads to one basic conclusion: The shorter the time frame you may have with a residence, the more likely renting will be the right decision.

Even if you’re thinking of living in a certain place for a longer period, you still might want to consider renting if you’re in a market where home prices are especially high, relative to rentals. We’re seeing this a lot lately, with less than 1% of the houses in Maine up for sale. Inventory is still low, and house prices are ‘sticky’ – people don’t like to lower their price when selling.

A good rule of thumb is based on something called a ‘Rent Ratio’. You derive this number by taking the sales price of a home you’d consider buying and dividing that number by the annual cost of renting (most of the time, that will be the monthly rent x 12.). If that number is well below 18, buying could be an appropriate decision. However, if the Rent Ratio is above 18, it’s a good chance you’ll do better, at least for the time being, by renting.

Importantly, keep in mind that renting isn’t forever. You can rent now and become a buyer later. If the numbers just aren’t adding up, you aren’t hurting your long-term financials by putting off a house purchase. You might actually be making the best financial decision by renting!