Social Security Mulligans: Can you get a ‘Do-Over’?

Social Security Mulligans: Can you get a ‘Do-Over’?

The U.S. Social Security system provides for a huge amount of flexibility in how and when workers and their dependents access benefits. For example, even though your ‘Full Retirement Age (FRA)’ under Social Security might be age 67 (that’s the FRA for people born in 1960 and later), you can choose to start a reduced benefit at age 62 or delay receiving your benefit and receive permanent ‘Delay Credits’ up to age 70.

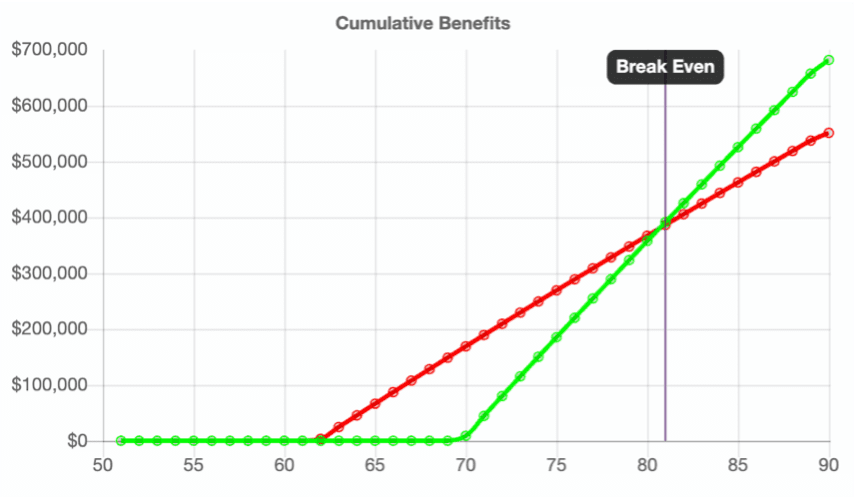

Flexibility has its benefits, but it can also cause some degree of stress because it implies that a decision needs to be made – one that could have lasting impact, financially. For example, the decision to delay benefits until age 70 could be a great one for someone who lives a long time. For someone with a shorter life span, the increased benefit may not be enough to make up for the years of delay where no benefit was received at all. Since most people don’t know exactly how long they’ll be around, this takes some educated guesswork.

Fortunately, for some, the decision to start a Social Security benefit isn’t always irreversible. You CAN stop and restart your Social Security benefits under certain circumstances. If you have already claimed your Social Security benefits and want to stop them, you can voluntarily suspend your benefits once you reach full retirement age. Again, that age is 67 for folks born in 1960 and later… it’s a little earlier for people born before 1960. By suspending your benefits, you can earn delayed retirement credits, which increase your future benefit amount.

Why would someone want to change their mind? There are several potential reasons, including:

- Changing financial circumstances: If someone’s financial situation changes, they may prefer to halt their Social Security benefits temporarily to avoid a reduction in benefits and resume them later when it’s more advantageous. A reduction in living expenses or a windfall like an inheritance are frequently things that reduce the need for Social Security and lead people to want to maximize benefits by putting them off.

- Regaining larger benefits: Sometimes, individuals start receiving Social Security benefits early (before reaching full retirement age) but later realize it would be more beneficial to delay claiming. In such cases, halting benefits and waiting to restart can result in higher monthly payments later on.

- Return to work: If someone begins working again while receiving Social Security benefits, they might want to stop benefits temporarily to avoid the earnings limit. Social Security sets an annual income threshold, and if this limit is exceeded, benefits may be reduced. After reaching full retirement age, earnings no longer impact benefit payments.

- Beneficiary changes: In some cases, individuals may initially claim their own Social Security benefits but later become eligible for spousal or survivor benefits that provide a higher payment. In such situations, it may be advantageous to stop their own benefits and switch to the higher-paying option.

On the other hand, if you are already receiving benefits and want to stop them before reaching full retirement age, you can withdraw your application within 12 months of initially claiming. However, you need to repay all the benefits you received, including any spousal or dependent benefits based on your record. If you withdraw your application, it’s as if you never claimed benefits, and you can reapply in the future to potentially receive higher monthly payments.

Benefits can’t be stopped and re-started multiple times. You only get one ‘mulligan’. But having this ‘optionality’ available is yet another example of how Social Security provides flexibility (and complexity!) for its participants.